new york salt tax workaround

Late last year the IRS issued a notice which allowed the deductibility of the entity-level tax in calculating flow-through income of the entity owner blessing this version of the SALT deduction workaround. The increased tax rates are presently scheduled to sunset and.

New York S Salt Workaround New Guidance Affected Industries And What To Know Before The October 15 2021 Deadline Insights Venable Llp

New York State legislature included a SALT workaround in the most recently approved budget passed on April 6 2021.

. Tax Increases SALT Cap Workaround and Additional COVID Relief By James Jay M. In most states the owner. The New York State legislature and NYS Governor Cuomo reached an agreement for the fiscal year 20212022 state budget.

When coupled with New York Citys tax rate of 3876 though at 14776 city residents may be paying the highest state and local tax rates in the country. The Budget Act includes a provision that allows partnerships and NYS S corporations to elect to pay NYS tax at the entity level in order to mitigate the impact of the 10000 cap on SALT deductions. New York has issued long-awaited guidance and clarifications on the Pass-Through Entity Tax PTET via a Taxpayer Services Bulletin issued on August 25 2021 TSB-M-21 1C 1I.

16 2020 New York legislation was submitted to impose an unincorporated business tax UBT on partnerships and limited liability companies that are treated as. This tax is a state level tax assessed and paid at the entity level with a. Friday December 18 2020.

GT Alert_Proposed New York State Unincorporated Business Tax Provides SALT Limitation Workaround. The Pass-Through Entity tax allows an eligible entity to pay New York State tax. New York States new budget for 2022 included an elective Pass-Through Entity Tax PTE and a corresponding personal income tax credit.

The New York state budget deal announced yesterday includes a workaround of the temporary federal limit on state and local tax deductions the SALT cap. SALT cap workaround enacted for 2023. New York State Lawmakers Finally Agree to SALT Workaround.

The period to opt-in to the New York PTET has ended for tax year 2021 but for tax years 2022. 2 days agoEnacted by the Tax Cuts and Jobs Act of 2017 the SALT cap spurred legislation in Connecticut New Jersey and New York that allowed residents to bypass the limit. New York States April 2021 budget now law created a workaround to the SALT limitation in the form of a pass-through entity tax PTET which is an optional tax that partnerships or New York S Corporations may annually elect to pay on certain New York source income.

Learn about New Yorks pass-through entity tax to help you work around it. The provision was part of Gov. Enacted by the Tax Cuts and Jobs Act in 2017 the SALT cap has been a pain point for filers in high-tax states such as New York and New Jersey.

Remember the deadline to elect into New Yorks entity-level tax workaround. Connecticuts pass-through entity PTE tax for the SALT cap workaround is mandatory which is unique. The new tax which is included in Budget Bill A09009C is effective for tax years starting on or after January 1 2023.

Since its purpose is to provide a SALT limitation workaround to New York State taxpayer individuals the tax is imposed at rates equivalent to the current and recently increased New York State personal income tax ratesthat is at 685 percent of pass-through entity taxable income of up to two million dollars with excess income taxed at. Cuomos initial budget proposal in January and it comes at a time when many Democrats are calling on Pres. This election can alleviate the loss of the SALT deduction suffered by many New York taxpayers as a result of the federal SALT cap whether they are New York residents or.

New York State 20212022 Budget Act SALT Cap Workaround The New York State NYS 20212022 Budget Act was signed into law on April 19 2021. A major part of the budget. Biden to include the elimination of the SALT cap as.

The New York state budget deal announced yesterday includes a workaround of the temporary federal limit on state and local tax deductions the SALT cap. 16 2020 New York legislation was submitted to impose an unincorporated business tax UBT on partnerships and limited liability companies that are treated as partnerships for federal tax purposes. The PTET provisions in California and New York generally follow the standard SALT cap workaround formula.

And some lawmakers have been fighting to include a. On April 6 2021 New York Gov. A small business may elect to pay tax at the entity level and a corresponding credit is allowed at the partner member or shareholder level.

13 April 2022 pdf Download pdf 14 MB. Andrew Cuomo and the state legislature agreed to the fiscal year 2022 budget making a number of changes to the states tax code through Senate Bill 2509Assembly Bill 3009C including personal and corporate income tax rate increases an optional pass-through entity tax workaround and numerous other provisionsIt is anticipated. The tax is phased in over three years beginning.

The PTE election deadline for New York State is October 15 2021. The provision was part of Gov. New Guidance Affected Industries and What to Know Before the October 15 2021 Deadline.

On April 6 2021 New York Gov. Through New Yorks other SALT workaround known as the states Employers Compensation Expense Tax ECET employers that opt in will pay a payroll tax on employees annual wages of 40000 or more and employees will receive a tax credit corresponding in value to the payroll tax paid. The deadline to elect into New Yorks entity-level tax workaround to the federal SALT cap is October 15 2021.

The limitation on the deductibility of state and local taxes SALT at 10000 was part of the Tax Cuts and Jobs Act back in 2017. New Yorks SALT Workaround. Andrew Cuomo and the state legislature agreed to the fiscal year 2022 budget making a number of changes to the states tax code through Senate Bill 2509Assembly Bill 3009C including personal and corporate income tax rate increases an optional pass-through entity tax workaround and numerous other provisionsIt is anticipated.

You May Also Be Interested In. New York State enacted a work-around for the 10000 SALT deduction limitation in its budget bill signed into law in the spring of 2021 see our prior Alert here. The assembly and senate have passed the budget legislation and the legislation has been delivered to the governor for signature.

New York State Budget Changes.

New York State Elective Pass Through Entity Tax Salt Cap Workaround Dannible And Mckee Llp

Irs Issues Guidance On Salt Cap Workarounds 2020 Articles Resources Cla Cliftonlarsonallen

Governor Signs Bill That Could Provide Pass Through Entities A Salt Deduction Cap Workaround

Pass Through Entity Salt Cap Workaround Lancaster Cpa Firm

New York State Lawmakers Finally Agree To Salt Workaround Barclay Damon

New York City Salt Cap Workaround Enacted For 2023 Kpmg United States

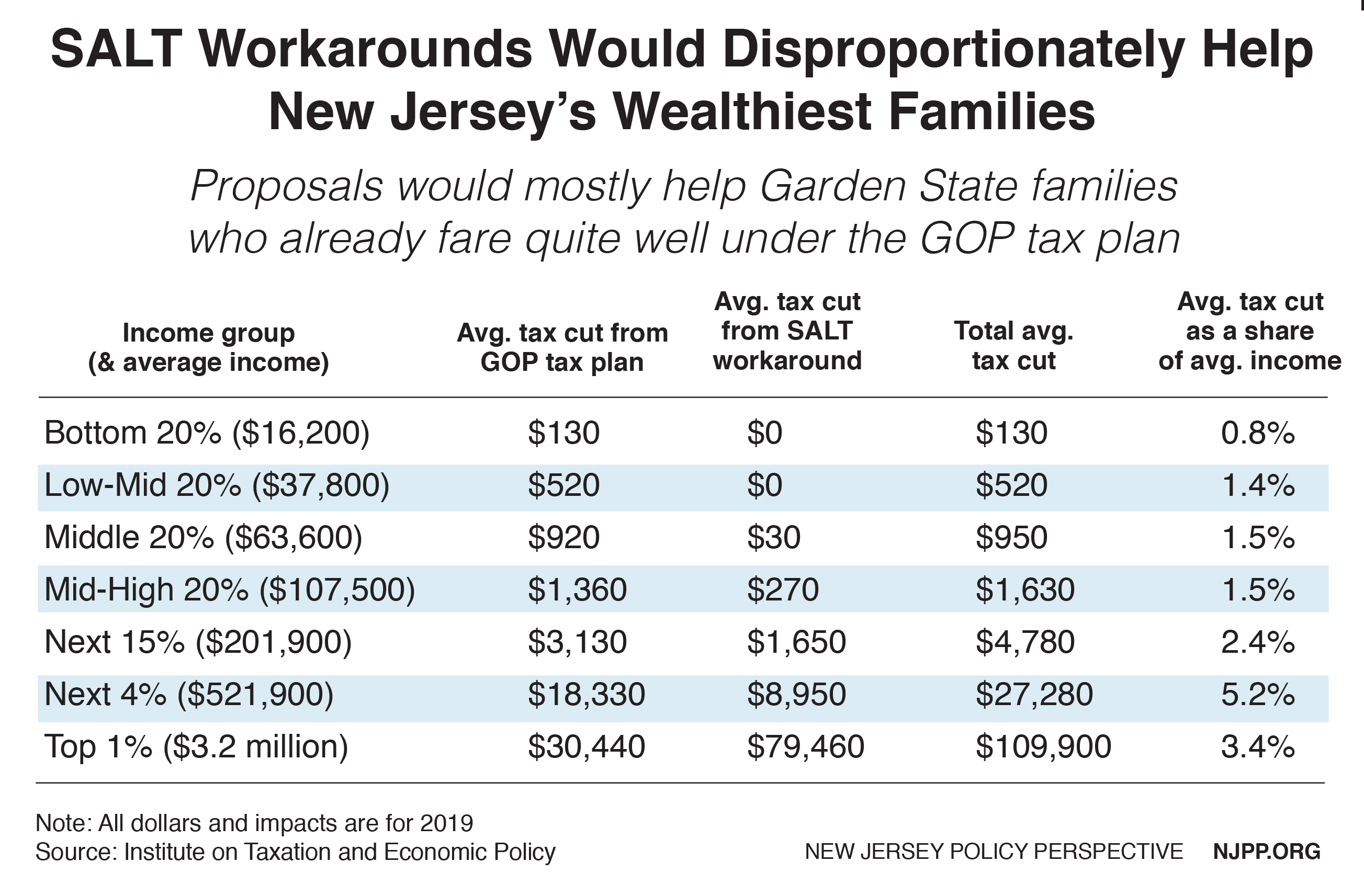

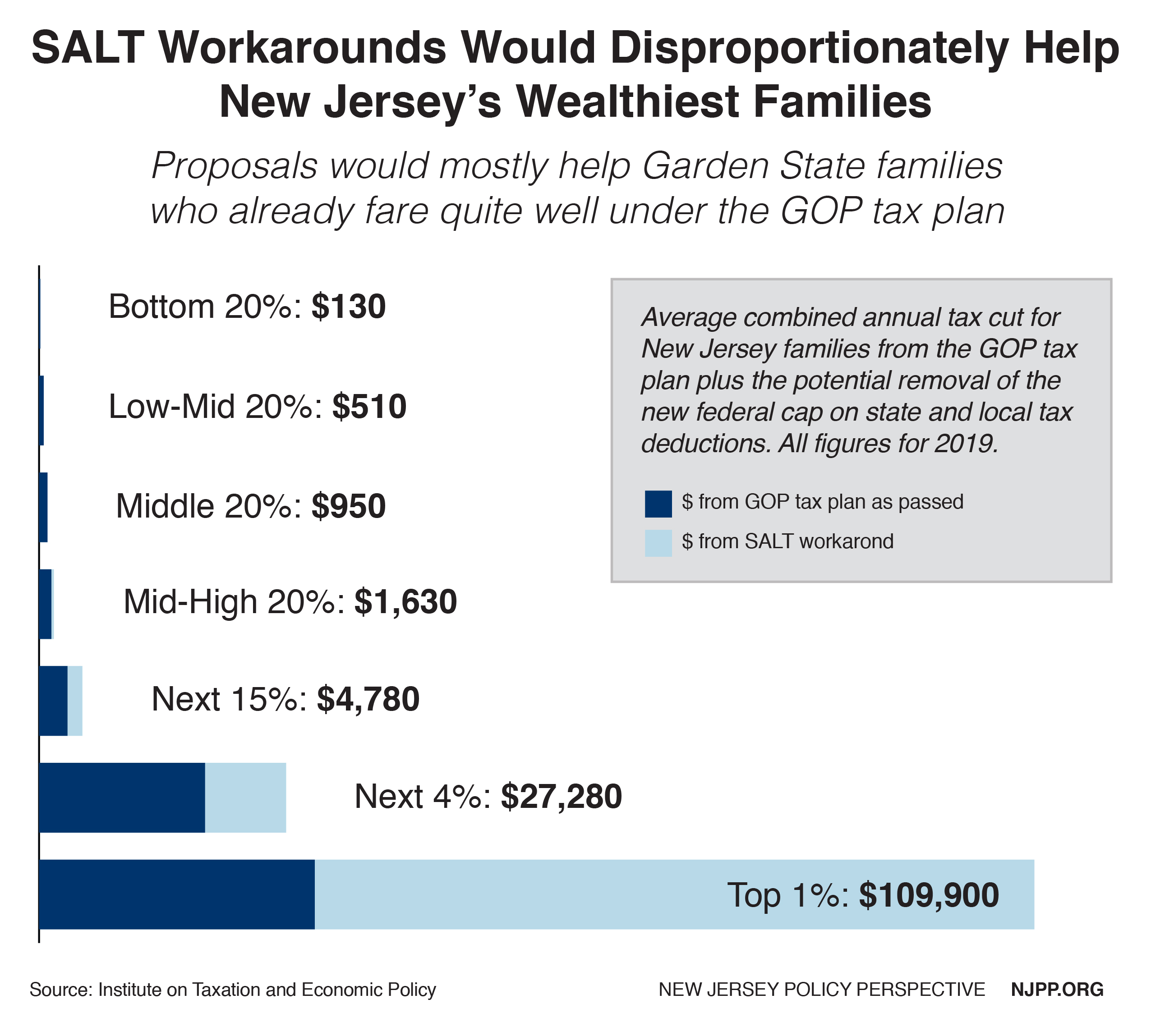

A Grain Of Salt New Jersey Needs More Than Workarounds To Respond To Gop Tax Plan New Jersey Policy Perspective

A Grain Of Salt New Jersey Needs More Than Workarounds To Respond To Gop Tax Plan New Jersey Policy Perspective

What Does New York State S Pass Through Entity Tax Mean Foryou Rosenberg Chesnov

Ny State Pass Through Entity Tax A S A L T Cap Workaround Fuoco Group

Itep Resources On Proposed Salt Workaround Regulations Itep

What The New York Pass Through Entity Tax Means For Private Equity And Venture Capital

What Is California Ab 150 Salt Workaround Acap Advisors Accountants

Irs S Salt Workaround Regulations Should Be Strengthened Not Rejected Itep

What The New York Pass Through Entity Tax Means For Private Equity And Venture Capital

Salt Limitation Workaround Proposed In New York State

Salt Deduction Work Arounds Receive Irs Blessing Look For More States To Enact Them Marks Paneth

Unlock State Local Tax Deductions With A Salt Cap Workaround Green Trader Tax