are donations to politicians tax deductible

Political contributions deductible status is a myth. In 2022 an individual may donate up to 2900 to a candidate committee in any one federal election up to 5000 to a PAC annually up to 10000 to a local or district party committee annually and up to 35000 to a national party.

Charity Give A Little Make A Big Difference Riddhi Siddhi Welfare Charitable Trust Ek Kadam Sewa Ki Or Riddhisiddhiwelfar Siddhi Charitable Welfare

While you cant write off campaign contributions you can set aside 3 of your taxes to go to the Presidential Election Campaign Fund on your 1040 federal income tax return.

. Any money voluntarily given to candidates campaign committees lobbying groups and other political organizations is non-deductible as per the IRS. So if you support your favorite candidate you. View solution in original post.

The simple answer to whether or not political donations are tax deductible is no. While political contributions arent tax-deductible many citizens still donate money time and effort to political campaigns. This doesnt just mean that donations made to candidates and campaigns are excluded from being tax deductible.

Simply put political contributions are not tax-deductible. However the truth is that political donations are not tax-deductible. The simple answer to whether or not political donations are tax deductible is no.

Political Campaigns Are Not Registered Charities. The IRS which has clear rules about what is and is not tax-deductible notes that any contributions donations or payments to political organizations are not tax-deductible. Although political contributions are not tax-deductible there is always a limit to the amount that can be contributed to a political campaign.

The most you can claim in an income year is. Here are the main reasons why. It also extends to political action.

Americans are encouraged to donate to political campaigns political parties and other groups that influence the political landscape. This includes Political Action Committees PACs as well. Even though you cant deduct political donations as charitable contributions on your federal return doesnt mean all is lost.

1500 for contributions and gifts to political parties. Arkansas residents can get a 50 tax credit per taxpayer so 100 for a couple filing a joint return for cash contributions made by the taxpayer in a taxable year to one or more of the. You can list specific deductions on Schedule A on Form 1040 follow the instructions provided by the IRS or seek the help of a tax professional.

A contribution donation or payment made as a contribution to contribution donations or payments for any of these that amount cant be deducted from your taxes. Are Charity Donations Tax Deductible. Yes certain donations are tax-deductible and can reduce your taxable income.

You can only claim deductions for contributions made to qualifying organizations. Political contributions arent tax deductible. You are not allowed to deduct political contributions from your taxes according to the IRS.

In any case you have to pay taxes on your political donations. 100 limit on cash contributions A campaign may not accept more than 100 in cash from a particular source with respect to any campaign for nomination for election or election to federal office. The IRS makes it clear that you cannot deduct contributions that you make to any organizations that arent qualified to receive tax-deductible donations.

Are Political Donations Tax Deductible. No donations to political parties are not tax deductible. Most of the time donors have big money and they qualify to be in a millionaire group at least.

1500 for contributions and gifts to independent candidates and members. As of 2020 four states have provisions for dealing with political contributions. Charitable contributions are tax deductible but unfortunately political campaigns are not registered charities.

In a nutshell the quick answer to the question Are political contributions deductible is no. In order to claim a tax-deductible donation there are certain steps youll need to take on your tax return. When it comes time to file taxes though many people may not fully understand what qualifies as a tax deduction.

Even so they are not exempted from taxes on political donations as per the US federal law. You need to claim your tax deduction for a political contribution or gift in the income year you made the contribution or gift. There are five types of deductions for individuals work.

The answer to the question Are political donations tax-deductible is simply No May the entity be an individual a business or a corporation all kinds of political donations come under those opted purely by choice and hence can not be recognized as tax-deductible as per IRS rules and regulations. A tax deduction allows a person to reduce their income as a result of certain expenses. Note that even though political donations are not tax deductible the IRS still limits how much money you can contribute for political purposes.

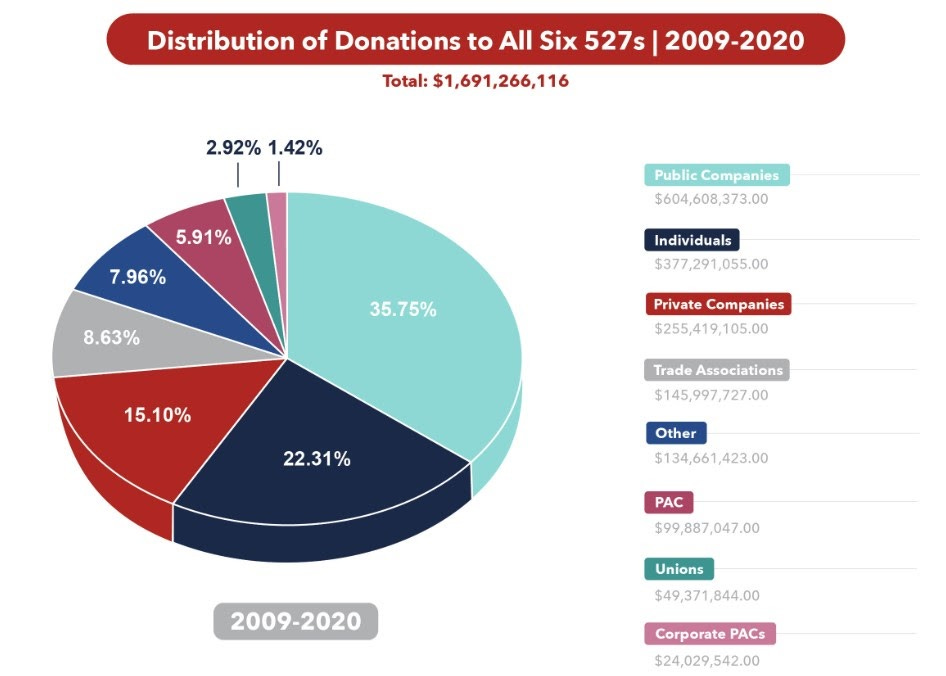

As more and more people have become politically involved in recent elections especially at the national level the amount of. Thats because political parties organizations and candidates arent considered charities referred to as qualifying organizations for purposes of federal income taxes. However there are still ways to donate and plenty of people have been taking advantage of them over the past several years.

In fact the IRS specifically calls out political donations as something you cant take as a charitable deduction on your federal return. The IRS guidelines also go beyond just direct political contributions. Individuals can contribute up to 2800 per election to the campaign committee up to 5000 per year for PAC and up to 10000 per year for local or district party committees.

Montana offers a tax deduction.

Donations To The Film Have Been Amazing Thanks To All Who Made Tax Deductible Donations Via Www Jmhsaa Org Documentary Donations O High School Film John Muir

Charity Navigator Top 5 Things To Remember When Making Political Donations

Are Political Contributions Tax Deductible H R Block

Are Political Contributions Tax Deductible H R Block

The Truth About Political Donations There Is So Much We Don T Know

501 C 3 Vs 501 C 4 Key Differences And Insights For Nonprofits

How Corporations Give Republicans A Massive Financial Advantage In State Politics

Are Political Contributions Tax Deductible Smartasset

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Are Political Contributions Tax Deductible Smartasset

Limiting Secret Money In Politics Crew Citizens For Responsibility And Ethics In Washington

Are Political Contributions Tax Deductible Personal Capital

How The 3 Campaign Contribution Check Box On Your Tax Form Works Marketplace

Senators Issue Bipartisan Call To Restore Donors Tax Breaks The Columbian

Are Political Contributions Tax Deductible Smartasset

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos

Don T Let Congress Convert Charities Including Churches Into Dark Money Political Organizations Nonprofit Law Blog